work opportunity tax credit questionnaire (wotc)

The bill which has passed the state Senate provides a. The WOTC is available for wages paid to certain individuals who begin work on or be See more.

Completing My Work Opportunity Tax Credit Wotc Eligibility Questionnaire

We would like you to know that although this questionnaire.

. Work Opportunity Tax Credit Questionnaire. First with the New York Job Tax Credit the benefit is equal to one hundred percent of the State withholding tax up to 5000 for each job created above a businesss 2010. What restaurant owners need to know about the WOTC.

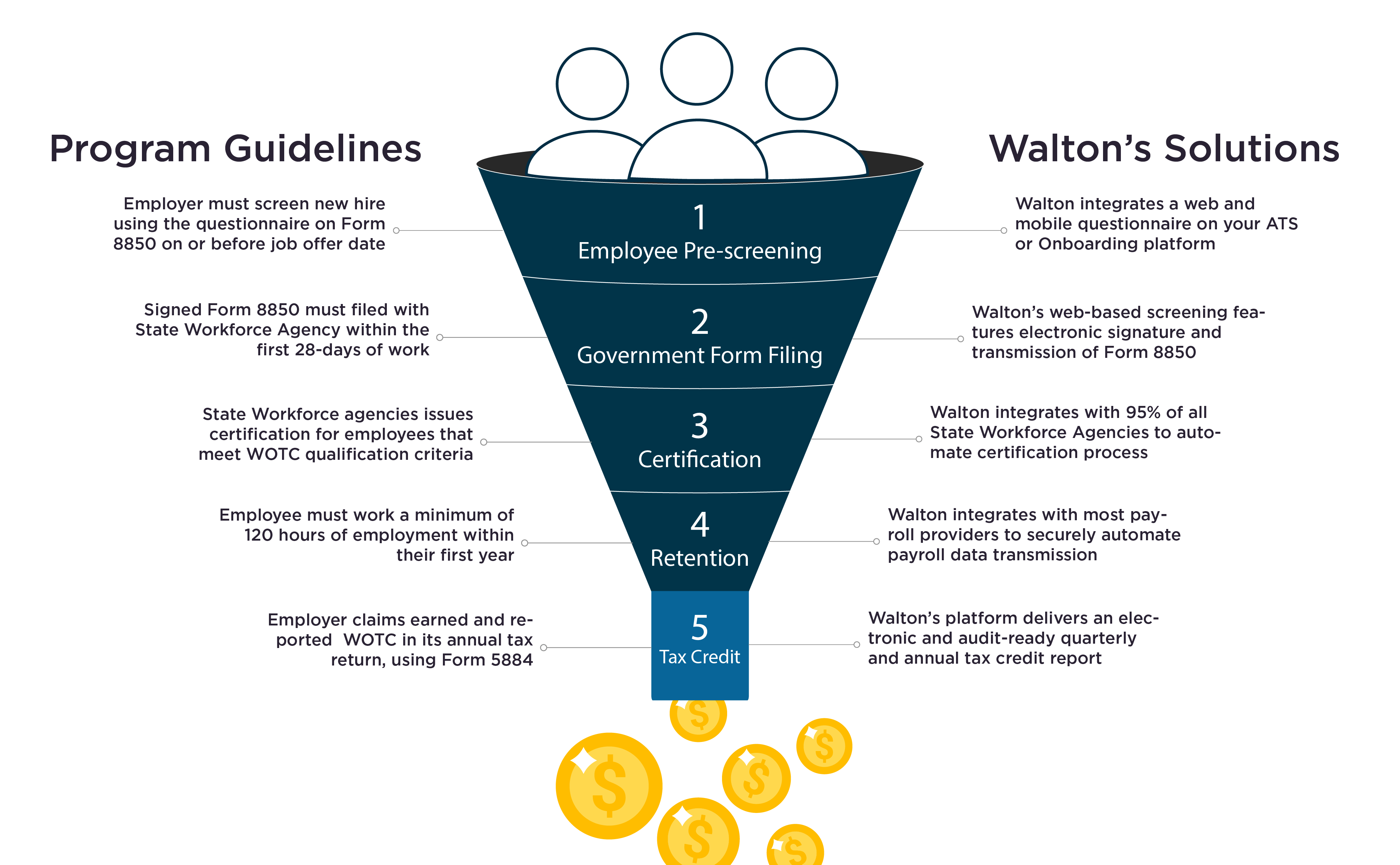

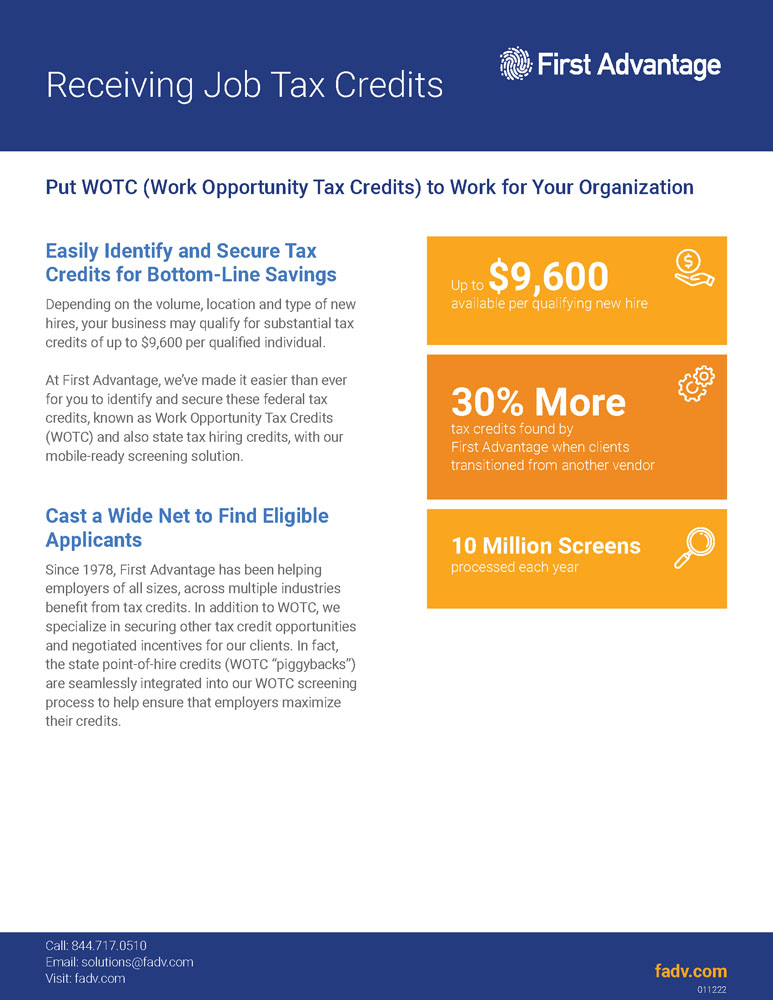

Your restaurants salaries and qualified wages expense claimed on your tax return must be reduced by any amount of. Work Opportunity Tax Credits WOTC can help your bottom line but you also can leverage WOTC hiring tax credits to help accelerate DEA initiatives to help employee retention. The Work Opportunity Tax Credit or WOTC is a general business credit provided under section 51 of the Internal Revenue Code Code that is jointly administered by the Internal Revenue Service IRS and the Department of Labor DOL.

If you are in one of the target groups listed below an employer who hires you could receive a federal tax credit of up to. New York State Senator Joseph P. Is participating in the WOTC program offered by the government.

The program has been. The Work Opportunity Tax Credit WOTC is a federal tax credit available to employers for hiring individuals from specific target groups who have consistently faced significant barriers to. The Work Opportunity Tax Credit WOTC can help you get a job.

Please take this opportunity to complete an additional applicant assessment. An equal opportunity employerprogram. WOTC Eligibility Questionnaire The Work Opportunity Tax Credit program WOTC promotes workplace diversity and facilitates access to good jobs for American workers.

Questions and answers about the Work Opportunity Tax Credit program. WOTC Work Opportunity Tax Credit Questionnaire KS Staffing Solutions Inc. All voice telephone numbers on this website may be reached by.

Auxiliary aids and services are available upon request to individuals with disabilities. The Work Opportunity Tax Credit WOTC is a federal tax credit available to employers who invest in American job seekers who have consistently faced barriers to employment. Join our WOTC subject matter expert Brian Kelly this month to learn about the Work Opportunity Tax Credit WOTC how much employers can save when they hire why.

Enacted in 1996 to replace the Targeted Jobs Tax Credit the Work Opportunity Tax Credit WOTC is designed to incentivize the employment of workers in certain categories. Addabbo issued a press release last week detailing his support for state senate bill S. As such employers are not obligated to recruit WOTC-eligible applicants and job applicants dont have to complete.

In mid-September the IRS released some updated information on the Work Opportunity Tax Credit WOTC a one-time federal tax credit available to employers for hiring and employing. WOTC Work Opportunity Tax Credit is a federal tax credit available to employers rewarding them for every new hire who meets eligibility requirements. The Work Opportunity Tax Credit is a voluntary program.

There are two sets of frequently asked questions for WOTC customers.

Adp Work Opportunity Tax Credit Wotc Integration For Icims Icims Marketplace

Bland Garvey Cpa Work Opportunity Tax Credit Provides Help Employers Richardson Tx

Wotc Questionnaire Fill Online Printable Fillable Blank Pdffiller

Work Opportunity Tax Credit Department Of Labor Employment

Irs Issues Revised Form 8850 Includes Wotc Target Group J Wotc Planet

An Employer S Work Opportunity Tax Credit Wotc Guide

Work Opportunity Tax Credits Wotc Walton

Work Opportunity Tax Credits Redfworkshop

What S The Deal With Work Opportunity Tax Credit

2016 2022 Form Irs 8850 Fill Online Printable Fillable Blank Pdffiller

Wotc 101 Arizona Department Of Economic Security

Form 9061 Fillable Fill Out Sign Online Dochub

All About The Work Opportunity Tax Credit

Could The Work Opportunity Tax Credit Help Your Construction Company Beachfleischman Cpas

Wotc Questions Do You Have An Online Application For Wotc Cost Management Services Work Opportunity Tax Credits Experts

Work Opportunity Tax Credit First Advantage

Taxadvantage Increase Savings With Tax Credits Trusaic

Work Opportunity Tax Credit Wotc Extension To November 8 2021 Ketel Thorstenson Llp